Employee Benefits Every Business Should Offer

Written by Heather Bussing

November 11, 2021

Employee benefits are an important part of compensation for everyone.

For employees, benefits can mean the difference between getting preventative and needed health care or not. Benefits can also provide a healthier workforce and a safety net of paid time off, flexible work, and retirement contributions.

For employers, benefits make the organization more competitive to attract new employees and retain the ones they have. A 2021 study found that current employees are looking for flexible work, tech tools to support remote work, mental health support, and childcare. Another recent study found that new graduates want health care, matching retirement contributions, and flexible hours.

Choosing Employee Benefits

When choosing benefits, start by reviewing what you have and whether employees use it, what your budget is, and what employees would like to see added. But before you survey employees about what they want, be sure you have the resources to implement at least some of the employee benefits the survey identifies. Otherwise, you risk creating expectations that won't be met.

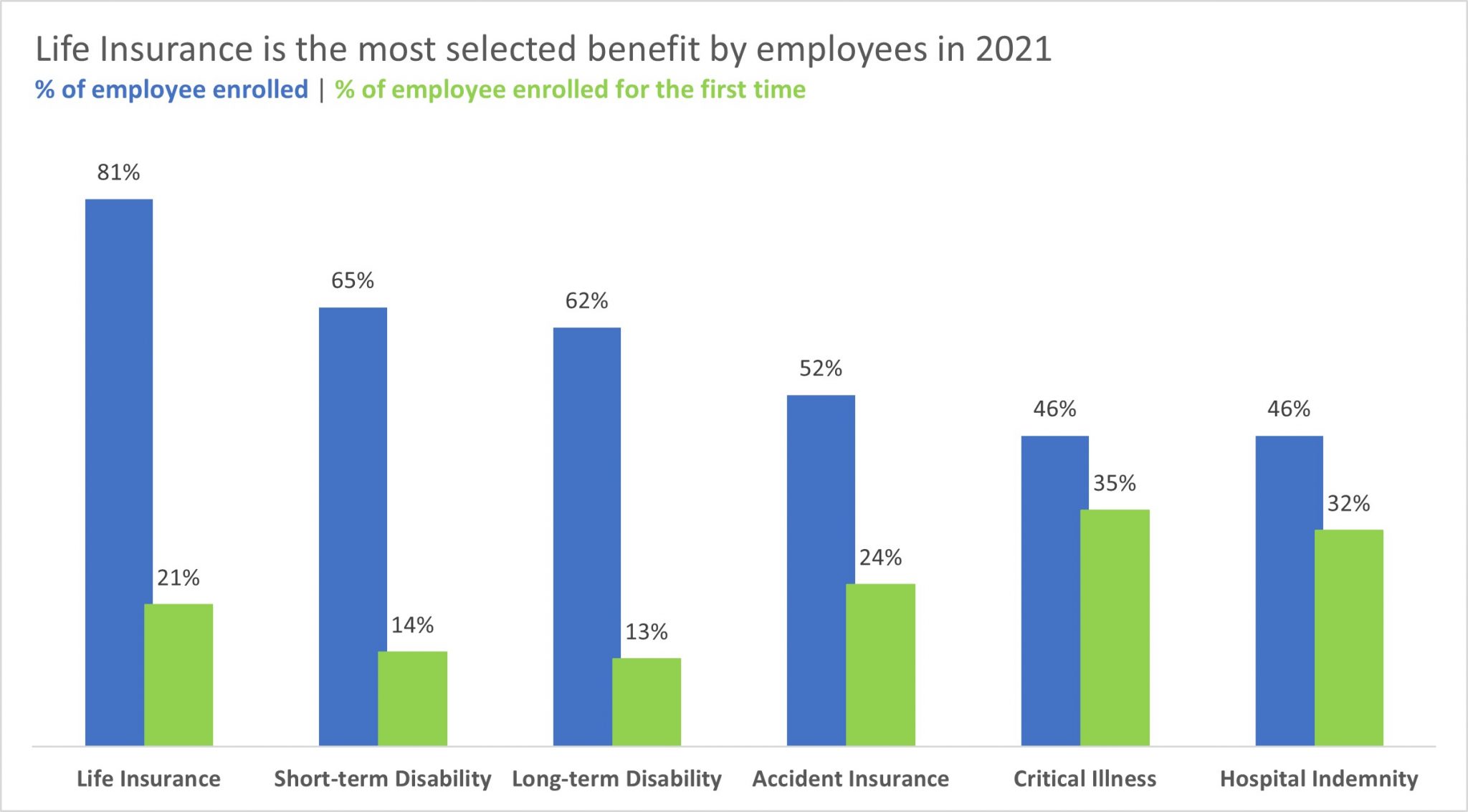

A 2021 Hartford study on the Future of Benefits, revealed that during the pandemic, 75% of employers increased paid leave for employees beyond what was required. The most common benefits employees participated in were:

- Life insurance

- Short-term and long-term disability

- Accident insurance

- Critical illness and hospital indemnity coverage

The study also focused on the increased awareness of mental health issues and how they affect productivity. Younger workers especially have struggled with depression and anxiety and it's important to address these issues with paid time off and mental health benefits.

As you put together benefits offerings for the coming year, here are some essential, nice-to-have, and extra care benefits to consider and ways to think about them.

The Essential Employee Benefits

Paid time off: Whether it is vacation, sick leave, paid holidays, or PTO, everybody needs days off and paid time off is an essential employee benefit. Rest is part of work. And giving people breaks when they need or want them is essential to the well-being of everyone. When looking at how to structure paid time off, be sure to talk to an employment lawyer familiar with wage hour laws in the states you have employees.

Health insurance: Medical, dental, and vision benefits are also an essential employee benefits because the cost to individuals is much higher than group rates through employers. If you want your workforce healthy, pick a plan that includes preventative care at little or no charge and pay as much of the employee premiums as the company can. Policies with high deductibles and co-pays can be like having no insurance at all if employees cannot afford the care. The cost of health insurance is tax deductible for the employer.

Retirement plans: Employer sponsored retirement plans help employees save for the future and are a benefit they can take with them when they leave. Vesting schedules and matching contributions are an incentive for employees to stay. These benefits can be tricky to administer, so get some expert help in setting up a plan.

Flexible work: During Covid-19, we learned new ways to work, re-evaluated work life balance, and figured out that work does not have to happen M-F from 9-5. Meanwhile, employers locked into long term building leases planned on people returning to a physical workplace. Why not both? Bring people to meet in person when it makes sense. Some people will want the structure of going to work and coming home. But for many, having flexibility about where and when they work fits with taking care of others, kids, and self-care. If you really want to bring people back on site, consider converting some of that space into childcare.

Mental health benefits or stipends: While the Affordable Care Act requires that health insurance plans cover mental health, many of the therapists and other providers don't want the hassle of dealing with insurance claims. This can limit the access to care even if there is some insurance coverage. Consider flexible spending accounts where both employers and employees can contribute pre-tax funds to cover healthcare costs, including therapy and other mental health expenses.

The Nice-to-Have Employee Benefits

Short and long term disability: If an employee is ill with a serious condition, disability insurance can cover unpaid time off the employee needs to recover. These policies often have waiting periods and other restrictions, so look for the most coverage for the price.

Student loan repayment help: Employers can pay up to $5,250 toward employee student loans without the payments being included in the employee's taxable income. Some employers offer a fixed amount while others increase the contribution with an employee's tenure. With many workers carrying student loan debt, this can be a differentiator that makes great financial sense for both the employer and employee.

Childcare: Whether it's an on site facility, financial help, or access to emergency childcare for last minute cancellations and closures, making life less stressful for parents with young kids will earn you loyalty and more productive, happy employees.

Professional development and tuition reimbursement: Part of having a successful business is helping employees learn and grow. It shows you care about them as people and are invested in their careers. Set up a tuition reimbursement plan for additional formal education or training or give employees an annual professional development budget. Investing in everyone's future is good for your organization.

Technology reimbursements: Whether your employees work on site, on the road, or on the couch, they may need special equipment for data security or a new computer that can handle zoom meetings and all day use. Good chairs, an extra screen, or even new window shades to handle the light can make a huge difference in employee health, comfort, and productivity.

Transportation reimbursements: Commuting can be expensive, even on public transportation. Giving employees a budget for transit passes, parking, tolls, gas or mileage will take the financial stress out of the commute.

Extra Care

Pet insurance: Many people adopted Covid puppies and kittens. Pet insurance can be an affordable way to help keep those pets thriving. Some policies are definitely better than others though, so try to get the broadest coverage.

Discounts: From mortgages and buying cars, to restaurants, clothing, and haircuts, many retailers and services offer discounts to employees as an incentive to use them. The cost to the employer is often little or none.

Fitness and Wellness Reimbursements: This can cover gym memberships, that Peloton bike, new walking or running shoes, massage therapy, dance and fitness classes, sports equipment, or anything else that gets people up, moving, and breathing.

On site wellness programs: Want to keep employees healthy this winter? Set up an onsite flu shot clinic. Create a walking trail. Add a gym or meditation space. Then encourage employees to use them. Breaks are important to health and better work.

Adventure and travel: Get people to use their vacation time by offering to pay for part of it. The ideal vacation is 8 days. That gives time to unwind, relax, and enjoy the break before it's time to go home. Encourage employees to take longer vacations to truly recharge by giving them discounts and reimbursement for travel.

While many of these employee benefits can seem costly, so is employee turnover. Start with the essentials and build from there as the company and budget grows.

In the meantime, you can never go wrong with free pizza.

Download our white paper to further understand how organizations across the country are using market data, internal analytics, and strategic communication to establish an equitable pay structure.

Insights You Need to Get It Right